how long does it take the irs to collect back taxes

This means that under normal circumstances the IRS can no longer pursue collections action against you if. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

1 Best answer.

. You Wont Get Old Refunds. If taxes are not paid on time there is a 10 late penalty. According to Internal Revenue Code Sec.

After the IRS determines that additional taxes are. The Internal Revenue Service the IRS has ten years to collect any debt. The IRS 10 year window to collect.

After that the debt is wiped clean from its books and the IRS writes it off. 21 Figuring out Your Collection Statute Expiration. April 14 2021 638 AM.

The tax assessment date can change. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. As already hinted at the statute of limitations on IRS debt is 10 years.

This means that the IRS can attempt to. The collection statute expiration ends the. The direct debit will occur on or after the date you specified when you selected the direct debit option.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. This is known as the statute of limitations.

As a general rule there is a ten year statute of limitations on IRS collections. Thankfully the IRS has a form you can fill out to request any tax information they have on file for you for a given year. Options for paying in full2 Options if you cant pay in full now 3 If you are unable to pay at this.

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Assessment is not necessarily the reporting date or the date on. 2 The Statute of Limitations for Unfiled Taxes.

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. This late penalty is added to the taxes owed and. Every year homeowners in Georgia must pay their property taxes in full.

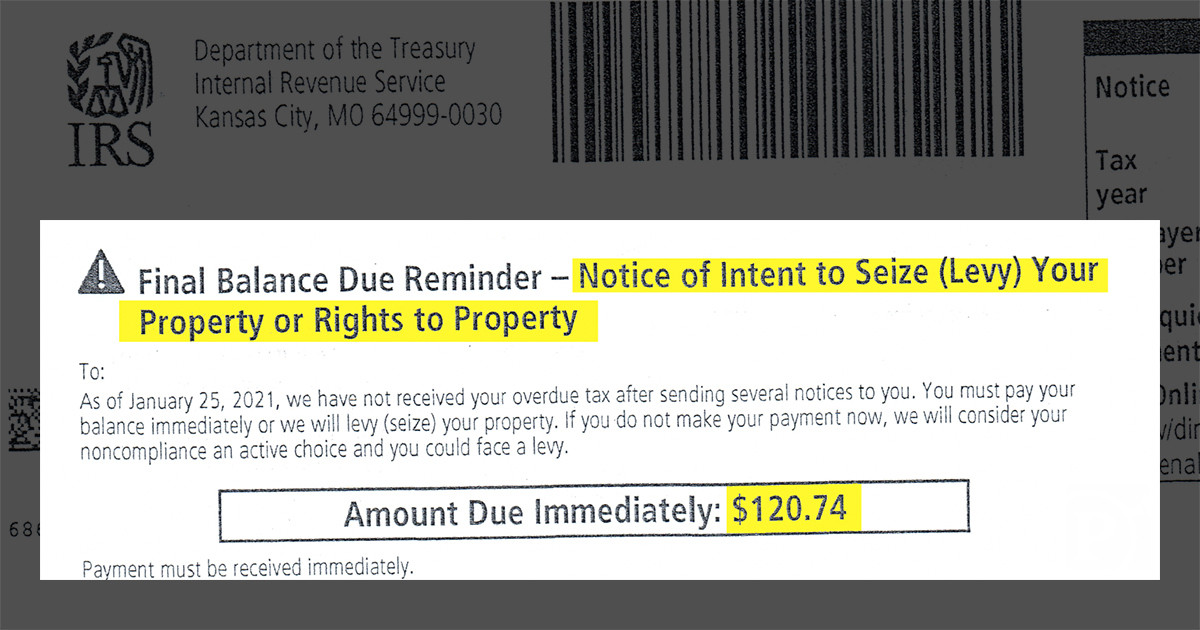

In the event of owing back taxes or failing to pay the IRS has the authority to seize take your property. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Ways to pay your taxes2.

1 Four Things You Need to Know If You Have Unfiled Tax Returns. How far back can the IRS collect unpaid taxes. Can The Irs Take Your Home If You Owe Back Taxes.

The IRS generally has 10 years from the date of assessment to collect on a balance due. What you should do when you get an IRS bill 2 Who to contact for help2. For filing help call 800-829-1040 or 800-829-4059 for TTYTDD.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. Form 4506-T allows you to request a transcript of your tax.

That statute runs from the date of the assessment. As stated before the IRS can legally collect for.

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Can The Irs Take Money From My Bank Account Manassas Law Group

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

The Top Seven Questions About Irs Tax Transcripts H R Block

How Many Years Back Can The Irs Collect Unpaid Back Taxes Wiztax

How Long Can The Irs Try To Collect A Debt

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Opinion How To Collect 1 4 Trillion In Unpaid Taxes The New York Times

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Youtube

Does The Irs Forgive Tax Debt After 10 Years

How To Prevent And Remove Irs Tax Liens Bc Tax

How Long Does The Irs Have To Collect Back Taxes Youtube

What Should You Do If You Haven T Filed Taxes In Years Bc Tax